What Sirono’s Financial Health App Means for Communications and Revenue

Increase capacity to collect by an order of magnitude

For many of our customers, communications are the key to stronger collections and higher patient satisfaction. The new Sirono Financial Health App unifies collections across departments and makes it easy for all representatives—not just financial service reps—to take payments, deposits, and much more.

The Massive Impact of Communications Inefficiencies

The Massive Impact of Communications Inefficiencies

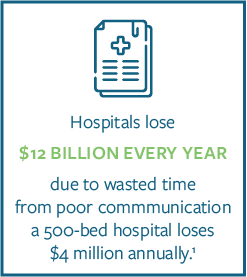

Healthcare providers lose a substantial amount of money to inefficient communications. It’s estimated that hospitals alone lose $12 billion every year due to wasted time from poor communication practices. To put that into perspective, a 500-bed hospital loses $4 million annually.1

This is primarily a calculation of inefficient resource utilization between providers, which means the real losses are much higher. These figures don’t account for the time and lost pay for contact center representatives, and much more importantly, the opportunities to collect that are lost along the way.

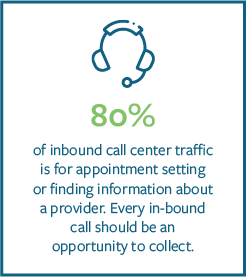

80% of inbound call center traffic is for appointment setting or finding information about a provider. But the agents who handle this overwhelming majority of patient communications are not only untrained in providing financial services, they typically lack the necessary access to information and tools to handle patient balances—even if they did have the training.

80% of inbound call center traffic is for appointment setting or finding information about a provider. But the agents who handle this overwhelming majority of patient communications are not only untrained in providing financial services, they typically lack the necessary access to information and tools to handle patient balances—even if they did have the training.

Multiply Collections Touchpoints

The Sirono Financial Health App is a lightweight and intuitive tool that enables every contact center agent to instantly assess a patient’s financial state, process payments, take deposits, and set up payment plans. Everytime an agent answers a phone call, they can collect a payment from any patient.

By aggregating data across departments, it eliminates the need to log into multiple systems, which not only streamlines customer service, it greatly reduces the requirements for financial service training.

By aggregating data across departments, it eliminates the need to log into multiple systems, which not only streamlines customer service, it greatly reduces the requirements for financial service training.

Making Financial Services as Simple as Possible

In addition to eliminating the need to learn and use multiple accounting systems, the Financial Health App is designed to guide agents through the collection process. First, it illustrates each patient’s financial health with badges and displays “Patient Satisfaction Score”, “Propensity to Pay Score”, “Missing Demographics”, “Charity Eligibility”, and “Bad Debt History.”

Next, the Financial Health App recommends the most effective follow-up actions for collections. These actions include “Take Payment”, “Take Deposit”, “Create a Payment Plan”, “Add Invoices to a Payment Plan”, and “Update A Payment Plan.” The rules that determine the ratings, scores and follow-up actions are completely customizable for any organization.

Empower Every Agent to Collect During Every Call

When inbound non-financial service calls become opportunities to collect, collection touchpoints are multiplied by an order of magnitude. The Financial Health App pays for itself almost immediately. And by streamlining customer service and reducing outbound calls for collections—oftentimes placed by agents from different departments to the same patient—patient satisfaction grows alongside collections.

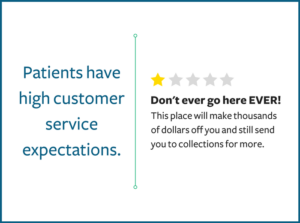

payment plans, and making payments is extremely inconvenient and confusing. Then you receive an HCAHPS survey. So how would

payment plans, and making payments is extremely inconvenient and confusing. Then you receive an HCAHPS survey. So how would  Communication:

Communication:

made patients become consumers of their healthcare, retail is now the most realistic and direct comparison for today’s patient expectations.

made patients become consumers of their healthcare, retail is now the most realistic and direct comparison for today’s patient expectations.

Amazon and many other consumer powerhouses use customer service platforms to provide the price transparency, fast resolutions, and convenient account access options outlined above.

Amazon and many other consumer powerhouses use customer service platforms to provide the price transparency, fast resolutions, and convenient account access options outlined above.

The financial impact of a bad last impression from billing cannot be overstated. In terms of direct losses, 67% of patients fail to pay their bills in full when frustrated with the billing process.1 The revenue lost from collection fees and write-offs is a major driver of the industry-wide rise of bad debt.

The financial impact of a bad last impression from billing cannot be overstated. In terms of direct losses, 67% of patients fail to pay their bills in full when frustrated with the billing process.1 The revenue lost from collection fees and write-offs is a major driver of the industry-wide rise of bad debt.

Take home repairs for example. Everyone who owns a home understands that one repair often and unfortunately leads to another. You get your furnace serviced for $75 and find that a $500 part needs to be replaced.

Take home repairs for example. Everyone who owns a home understands that one repair often and unfortunately leads to another. You get your furnace serviced for $75 and find that a $500 part needs to be replaced.

Even with current “best practices,” health systems collect less than 35% of patient financial liabilities. Trends in the healthcare industry have shifted greater financial liability onto the patient. The ACA and rising prevalence of high-deductible plans have increased patient copayments by 34%. As patients are unlikely to pay medical bills above 5% of their annual income, health systems will see patient bad debt rise and revenue shrinks—unless they recalibrate their strategies for collections.

Even with current “best practices,” health systems collect less than 35% of patient financial liabilities. Trends in the healthcare industry have shifted greater financial liability onto the patient. The ACA and rising prevalence of high-deductible plans have increased patient copayments by 34%. As patients are unlikely to pay medical bills above 5% of their annual income, health systems will see patient bad debt rise and revenue shrinks—unless they recalibrate their strategies for collections.